In the last few decades, there have been major changes that have impacted multiple businesses and these changes have been encouraged by the growth of the FinTech companies market. It has been noticed that the FinTech startups have the digital solution and can help in offering a competitive edge to the financial organizations. Financial technologies or FinTech is been innovated in a way that it replaces the traditional methods used for finances.

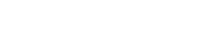

There are multiple software used and set on different working algorithms and business models. When you look at the growth charts of the different businesses that are indulged within the financial industry you will be surprised to see that FinTech with time has enhanced the multiple aspects of finance such as payment processing, lending money, and much more. Undoubtedly this switch has enhanced the user experience to a whole new level and customers have started embracing FinTech

Growth of FinTech companies in India

Before we move on to the challenges that the FinTech companies face let us witness some of the vital numbers that showcase the growth of the Indian FinTech market. According to the report of NASSCOM in 2016, the FinTech programming and administration advertising in India was said to be approx. $8 billion and was anticipated to grow 1.5 times by 2020. Later on, it was expected that the Indian FinTech market will be reaching $73 billion with a CAGR of 22% by 2021. And

as per the report of the Market screener, the FinTech market will be worth $26.5 trillion by 2022 at the global level.

Here through this graph, the growth of FinTech services is evident.

Why do FinTech companies need outsourcing for their development?

Now after when you have learned about FinTech companies and their growth it is time to look for the answer to the biggest question. What is the role of outsourcing within the FinTech companies’ growth? There are several top FinTech companies all across the globe that uses outsourcing services to make sure that their growth is smoothly supported. When tech and innovation move side by side there are different aspects over which they depend and in the end, they rely on each other for the final end growth.

Software and product management along with the financial topics experts are some of the crucial requirements that every FinTech-based industry requires. Outsourcing can be used for fighting against any unsettling issues that the FinTech-based industry faces. It is the outsourcing through which the expertise in the software development companies can easily invest their time in a cost-effective manner and develop mobile applications.

Major challenges faced by the FinTech companies

Various digital marketing innovations have brought up the multiple trends which keep on updating according to the technology within the FinTech industry. It has revolutionized how people have accepted these trends along with the different financial organizations. When we look back it is quite evident how slowly yet consistently the technologies have been advanced drastically and have provided people with different ideas to invest and manage their finances.

FinTech companies in India and all over the globe have sorted their path and are been very quick in adapting to the required change to make sure that they grow. This acceptance and openness towards the technology and innovations have enhanced their services and made the process more tech-oriented. However, every coin has two faces and so the stability that the technology has added within the FinTech companies is also been surrounded by various challenges.

Here through this blog, we have tried to help you look deeper into these common yet significant challenges that the FinTech industry is facing. Not just the issues but we will be also providing you with insight into how outsourcing work as the solution for these challenges. It will show you ways through which you can push your imaginations and will be able to attain clarity about the room for improvement that outsourcing creates within this industry. And the challenges are as follows:

- Block-chain integration: We already mentioned above that there are different FinTech technology and their versions that are been used within this industry. The growth of this industry all over the world is also been credited to the fact of changing and constant upgrading technology used here. It somehow helps in keeping the system updated and enhances the user experience. Talking blockchain technology is considered one of the applications that make the FinTech industry more trustworthy for users.

With the help of this application tracking and analyzing various aspects of the transactions done becomes easy. It also helps in preventing any hidden changes so that the user and the company can keep an eye on any sudden changes that are made so that the fraud can be prevented. But the challenge lies within the maintenance that this technology needs. Integrating blockchain technology is not easy and it has to be done by keeping the government guideline into consideration. So the adoption of this technology becomes smooth when it is been outsourced. As outsourcing service providers are often loaded with the latest version of all kinds of technologies and have skilled professionals sitting behind for smooth functioning.

- Data Security: One of the significant steps that any industry adding technology to their system is to protect the data from being dragged out. Internet and platform digitalization has definitely helped us a lot but it has also opened an unwanted gate for hackers and frauds. Although there are ways through which any un-happening can be prevented so data can be secured. Various technologies are been implemented within the financial organisations so that the data can be safe and users do not face any issues.

Data security for FinTech companies is a bit more challenging as there are different financial applications that users use as per their comfort level. And it needs to manage and secured and so it requires extra resources and upgraded technologies for the same. This challenge can be easily faced when this industry collaborates with outsourcing services.

- Lack of expertise for tech and mobile: Another significant element that is required within any company connected to FinTech in any way is the skilled experts having in-depth knowledge about the financial terms as well as the technology related to the same. There are aspects of this segment that lack and can be one of the crucial reasons to pull down the growth of the company. But when you have outsourced services these issues don’t hinder the growth at all. The outsourced skilled experts can help in enhancing the required expertise for the FinTech companies and assure them the perfection in their services by providing fully satisfactory user experience.

So here you scrolled through some of the vital challenges that the FinTech companies are facing and also witnessed how outsourcing is the answer to all the ifs and but’s that this industry faces. There are many other issues such as long- fundraising cycles, increasing losses, and missed out targets that the FinTech outscoring services can provide solutions to. There are different organizations ready to offer you outsourcing services for the FinTech challenge management but can you trust them with your investments?

Well of course not, trusting any random brand will be risky and there are many vital risks that you already manage being in the FinTech industry. So why not choose someone who is already trusted by many others and has proved themselves? Yes, the name you are thinking of is Volans Informatics Pvt. Ltd. Here you will be able to outsource all your financial and accounting-related services as per your requirement. You will be enjoying some premium higher-value services such as financial reporting, financial analysis, corporate tax, and many others.

Any above-mentioned challenges other than these that you are facing will be offered the best solution once you choose to connect with us. Taking the decision to rely on a third party for your outsourcing services is something huge and with Volans, you get it all with the added perks such as reduction in the operation cost, increments on your returns, easily handling for all your system, professionals experts for smooth functioning and so much more.

After partnering with the financial and banking services Volans helps in enhancing the overall experience of the customers by offering cutting-edge solutions for customer support. The delivery approach of omni channel call center service is been used by Volans so that a seamless experience can be offered to the customers which will ultimately improve the customer relation rate with the company.

To learn more about the services that Volans offers for the FinTech companies you can always visit https://volansinfo.com/industries/banking-finance/